The native token of Chainlink (LINK) stalled on Wednesday after a strong start to the week, giving back some of the gains on news about asset manager Grayscale filing to convert its closed-end fund into an exchange-traded fund (ETF).

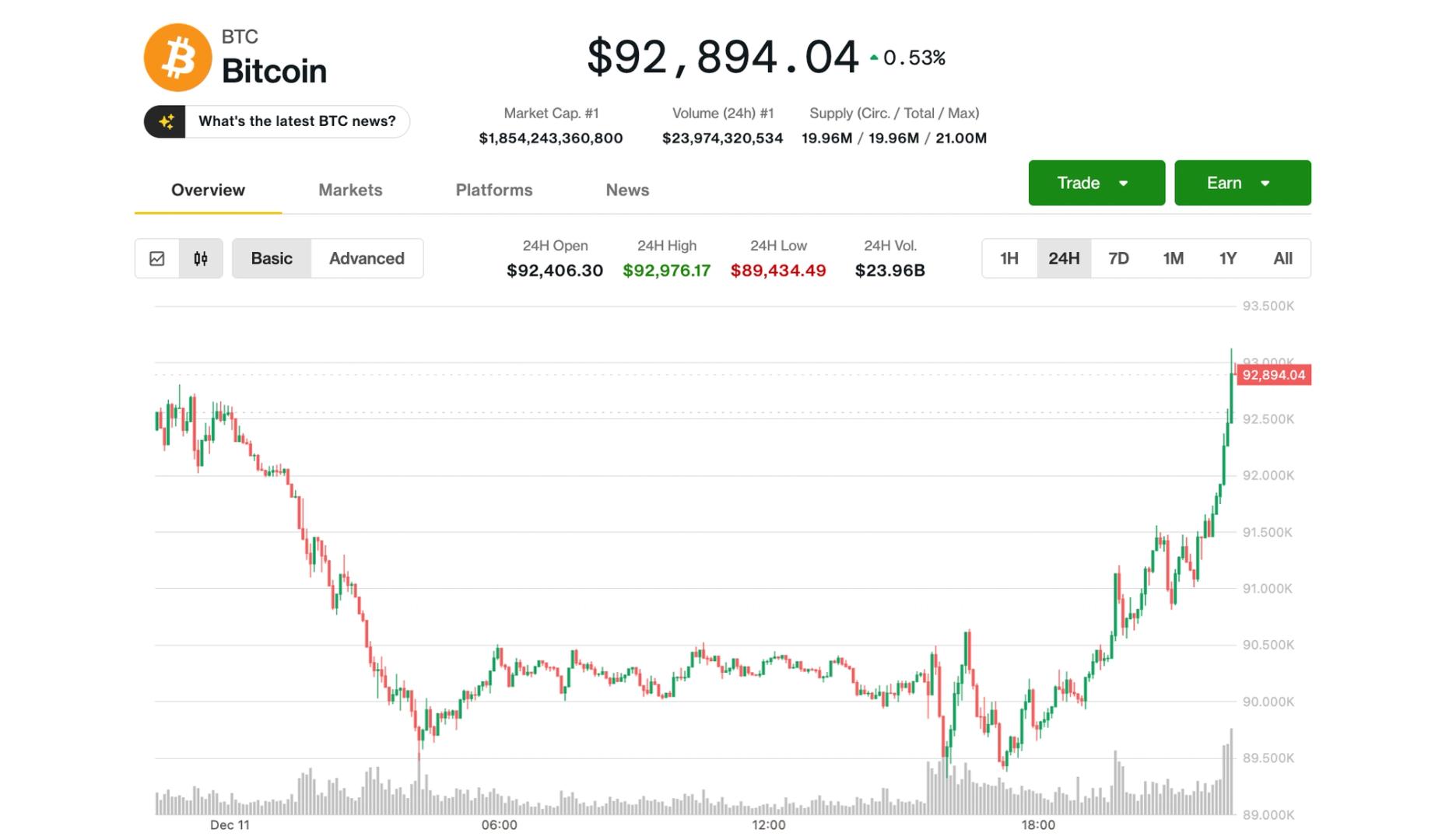

The token is down about 1% in the past 24 hours in a volatile session, experiencing a 7% price swing, per CoinDesk Research's technical analysis model.

The price action followed Arizona-based real estate and asset manager Caliber's (CWD) Tuesday announcement that it completed its first purchase of LINK tokens, marking the start of its digital asset treasury strategy.

Its stock skyrocketed nearly 2,000% on Tuesday before giving back a bulk of the gains, down another 20% on Wednesday pre-market. The firm didn't disclose the amount of tokens bought.

The move makes Caliber the first Nasdaq-listed firm to adopt a treasury reserve policy focused on LINK. The company said it aims to accumulate LINK over time using existing credit lines, cash reserves and equity-based securities, with plans to stake tokens to generate yield.

Technical analysis

- Trading Performance: LINK posted a modest 1% decline over the 24-hour period, experiencing volatile intraday swings of 7% between $22.84 and $24.46, CoinDesk Research's technical analysis model showed.

- Volume Indicators: Trading activity spiked to 3.78 million units at 14:00 on September 9:00 UTC, exceeding the 24-hour average and establishing support near the $23 price level.

- Resistance Testing: The intraday high of $23.49 encountered selling pressure before declining through minor support levels, indicating profit-taking activity and potential preparation for additional downside price discovery.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

3 months ago

30

3 months ago

30

English (US) ·

English (US) ·